Understanding the Eth Stock Price: A Comprehensive Guide

Are you intrigued by the world of cryptocurrencies and want to delve deeper into the Ethereum stock price? Look no further! In this detailed guide, we will explore various dimensions of the Ethereum stock price, providing you with a comprehensive understanding of this fascinating asset.

What is Ethereum?

Ethereum, often abbreviated as ETH, is a decentralized blockchain platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. Unlike Bitcoin, which is primarily a digital currency, Ethereum focuses on building a platform for developers to build and deploy decentralized applications.

Understanding the Ethereum Stock Price

The Ethereum stock price refers to the value of one Ethereum token in terms of a fiat currency, such as the US dollar. The price of Ethereum is influenced by various factors, including market demand, supply, technological advancements, regulatory news, and macroeconomic conditions.

Market Demand and Supply

One of the primary factors affecting the Ethereum stock price is the balance between supply and demand. When demand for Ethereum increases, its price tends to rise, and vice versa. Factors that can influence demand include the growing adoption of Ethereum-based DApps, the increasing popularity of decentralized finance (DeFi), and the rise of non-fungible tokens (NFTs).

On the supply side, Ethereum has a maximum supply of 18 million ETH, which is controlled by the Ethereum Foundation. The Ethereum network also undergoes periodic events called “forks,” where new blocks are added to the blockchain. These forks can impact the supply and, consequently, the price of Ethereum.

Technological Advancements

Technological advancements in the Ethereum ecosystem can significantly impact its stock price. For instance, the Ethereum 2.0 upgrade, which aims to transition the network to a proof-of-stake consensus mechanism, has been a major driver of price increases. This upgrade is expected to improve scalability, reduce energy consumption, and enhance security.

Regulatory News

Regulatory news and policies can have a significant impact on the Ethereum stock price. Governments around the world are still figuring out how to regulate cryptocurrencies, and any news regarding regulatory changes can cause volatility in the market. For example, a country’s decision to ban or restrict the use of cryptocurrencies can lead to a sharp decline in the price of Ethereum.

Macroeconomic Conditions

Macroeconomic conditions, such as inflation, interest rates, and economic growth, can also influence the Ethereum stock price. In times of economic uncertainty, investors may turn to cryptocurrencies as a hedge against inflation and traditional financial markets. Conversely, during periods of economic growth, investors may prefer to invest in traditional assets, leading to a decline in the price of Ethereum.

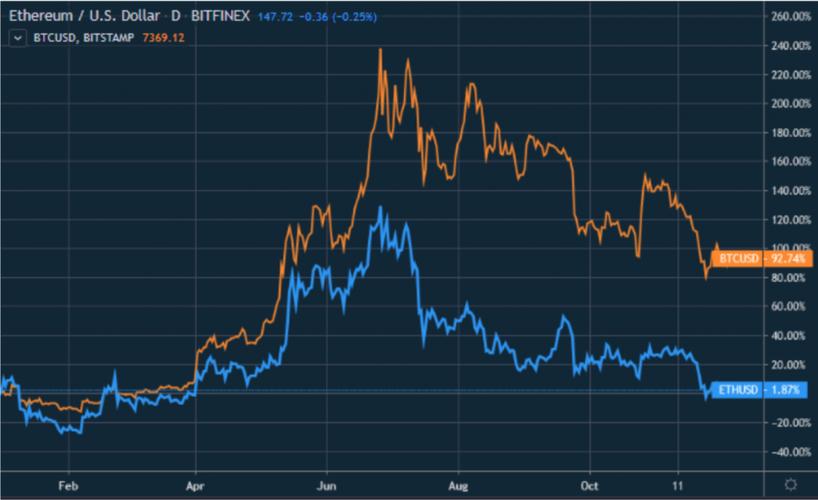

Historical Price Performance

Understanding the historical price performance of Ethereum can provide insights into its future potential. Below is a table showcasing the historical price of Ethereum from January 2018 to January 2021:

| Year | Price (USD) |

|---|---|

| 2018 | $1,300 |

| 2019 | $140 |

| 2020 | $600 |

| 2021 | $1,800 |

Conclusion

Understanding the Ethereum stock price requires considering various factors, including market demand and supply, technological advancements, regulatory news, and macroeconomic conditions. By staying informed and analyzing these factors, you can make more informed decisions regarding your investments in Ethereum. Remember that investing in cryptocurrencies involves risks, and it is essential to do thorough research before making any investment decisions.