Are you considering investing in Ethereum (ETH) with just 0.25 ETH? If so, you’ve come to the right place. This article will delve into the intricacies of Ethereum’s price history, factors influencing it, prediction methods, and how to keep a pulse on its real-time value. Let’s embark on this journey together.

Understanding ETH Price History

Ethereum’s native cryptocurrency, Ether (ETH), was officially launched on July 30, 2015, with an initial price of $0.31. The journey of ETH’s price has been tumultuous, to say the least.

| Year | Price Movement | Key Factors |

|---|---|---|

| 2015 | Initial rise to $2.8, then a decline to $0.6 | Initial market interest, Bitcoin price decline, Ethereum fork event |

| 2017 | Significant increase from $8 to $730 | Boom in ICO projects, DeFi applications, overall cryptocurrency market prosperity |

| 2018 | Sharp decline from $1400 to $85 | ICO bubble burst, regulatory pressure, hacking incidents, technical challenges, overall market downturn |

| 2019 | Stable at around $130 | Ethereum 2.0 upgrade plan, DeFi projects, ETH2.0 deposit contracts |

| 2020 | Increased from $130 to $730 | Boom in DeFi projects, ETH2.0 deposit contracts, Bitcoin’s influence, overall market recovery |

| 2021 | Increased from $730 to $6300 | Innovation in the Ethereum network, institutional interest, regulatory clarity |

Factors Influencing ETH Price

Several factors contribute to the fluctuation of ETH’s price:

-

Market Supply and Demand: The basic economic principle of supply and demand plays a crucial role. An increase in demand for ETH can lead to a rise in its price, while a decrease in demand can cause it to fall.

-

Regulatory Environment: Changes in the regulatory landscape can significantly impact the price of ETH. For instance, stricter regulations can lead to a decrease in demand, while favorable regulations can boost it.

-

Technological Developments: Innovations in the Ethereum network, such as Ethereum 2.0, can positively influence the price of ETH.

-

Market Sentiment: The overall sentiment in the cryptocurrency market can also affect ETH’s price. For example, a positive sentiment can lead to an increase in ETH’s price, while a negative sentiment can cause it to fall.

-

Competition: The rise of other cryptocurrencies can impact ETH’s price. If a new cryptocurrency gains significant traction, it may divert investors away from ETH, leading to a decrease in its price.

Prediction Methods

Predicting the future price of ETH is a challenging task. However, several methods can be employed to make educated guesses:

-

Technical Analysis: This involves analyzing historical price charts and using various indicators to predict future price movements.

-

Fundamental Analysis: This involves analyzing the underlying factors that influence ETH’s price, such as market supply and demand, regulatory environment, technological developments, and market sentiment.

-

Sentiment Analysis: This involves analyzing the overall sentiment in the cryptocurrency market to predict future price movements.

Real-Time ETH Price Tracking

Keeping track of ETH’s real-time price is essential for making informed investment decisions. Here are a few ways to do so:

-

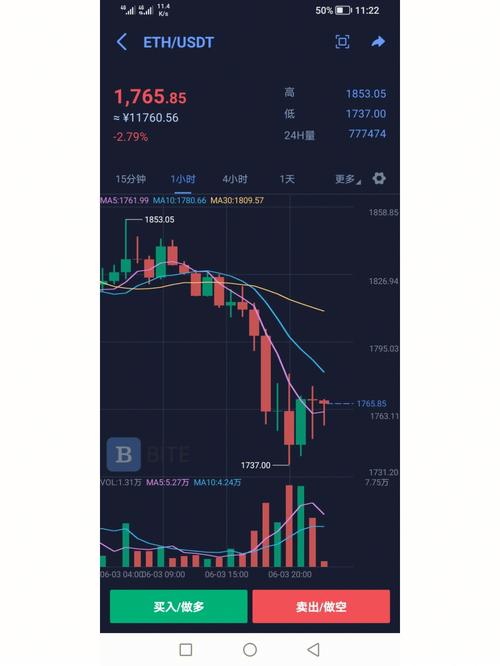

Crypto Exchanges: Many cryptocurrency exchanges provide real-time price updates on their websites and mobile apps.

-

C