Understanding ADA to USDT: A Comprehensive Guide

Are you considering trading ADA to USDT? If so, you’ve come to the right place. In this detailed guide, we’ll explore the ins and outs of ADA to USDT trading, covering everything from the basics to advanced strategies. Whether you’re a beginner or an experienced trader, this article will provide you with the knowledge you need to make informed decisions.

What is ADA?

Cardano (ADA) is a blockchain platform that aims to offer a more sustainable and scalable alternative to existing cryptocurrencies. Developed by Charles Hoskinson, the co-founder of Ethereum, Cardano is known for its peer-reviewed research and innovative approach to blockchain technology.

What is USDT?

Tether (USDT) is a stablecoin that is designed to maintain a stable value relative to the US dollar. It is backed by fiat currency reserves and is often used as a medium of exchange in the cryptocurrency market.

Understanding the ADA to USDT Market

The ADA to USDT market is a popular trading pair due to the growing popularity of Cardano and the stability offered by Tether. Here are some key points to consider:

| Market Factor | Description |

|---|---|

| Volatility | ADA is known for its high volatility, which can lead to significant price swings. |

| Liquidity | The ADA to USDT market is highly liquid, making it easy to buy and sell ADA. |

| Market Cap | Cardano has a significant market cap, making it a well-established cryptocurrency. |

| Transaction Fees | ADA transactions are relatively inexpensive compared to other cryptocurrencies. |

How to Trade ADA to USDT

Trading ADA to USDT is a straightforward process. Here’s a step-by-step guide:

- Choose a reputable cryptocurrency exchange that supports ADA and USDT trading.

- Create an account and complete the necessary verification process.

- Deposit USDT into your exchange account.

- Place a buy order for ADA using your USDT.

- Monitor your investment and adjust your strategy as needed.

Strategies for Trading ADA to USDT

When trading ADA to USDT, it’s important to have a solid strategy in place. Here are some common strategies:

- Day Trading: This involves buying and selling ADA within the same day to capitalize on short-term price movements.

- Swing Trading: Swing traders hold ADA for a few days to weeks, aiming to profit from medium-term price movements.

- Long-Term Holding: Some traders prefer to hold ADA for the long term, believing in its potential for growth.

Risks and Considerations

Like all investments, trading ADA to USDT carries risks. Here are some key considerations:

- Market Volatility: The cryptocurrency market is highly volatile, which can lead to significant gains or losses.

- Liquidity Risk: While the ADA to USDT market is generally liquid, there may be periods of low liquidity, which can affect price discovery.

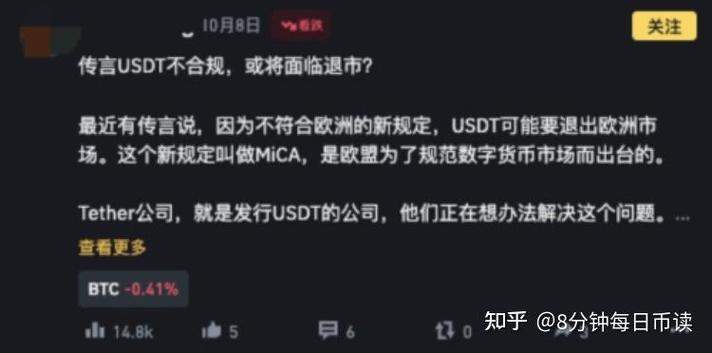

- Regulatory Risk: Cryptocurrency regulations are still evolving, and changes in regulations can impact the market.

Conclusion

Trading ADA to USDT can be a lucrative investment opportunity, but it’s important to do your research and understand the risks involved. By following the strategies outlined in this guide, you can increase your chances of success. Remember to stay informed about market trends and adjust your strategy as needed.