Understanding the Eth Coin Forecast: A Comprehensive Guide

Are you curious about the future of Ethereum (ETH)? Do you want to dive into the world of cryptocurrency and understand the potential of ETH? Look no further! In this detailed guide, we will explore the various dimensions of the ETH coin forecast, providing you with a comprehensive understanding of its potential and risks.

Market Analysis

When it comes to the market analysis of ETH, it’s essential to consider several factors. Let’s take a look at some of the key aspects that can influence the ETH coin forecast.

| Factor | Description |

|---|---|

| Supply and Demand | The balance between the number of ETH coins available and the demand for them can significantly impact the price. |

| Market Sentiment | Investor confidence and sentiment can drive the price of ETH up or down. |

| Regulatory Environment | Changes in regulations can either promote or hinder the growth of ETH. |

| Technological Developments | Innovations in Ethereum’s blockchain technology can positively influence the ETH coin forecast. |

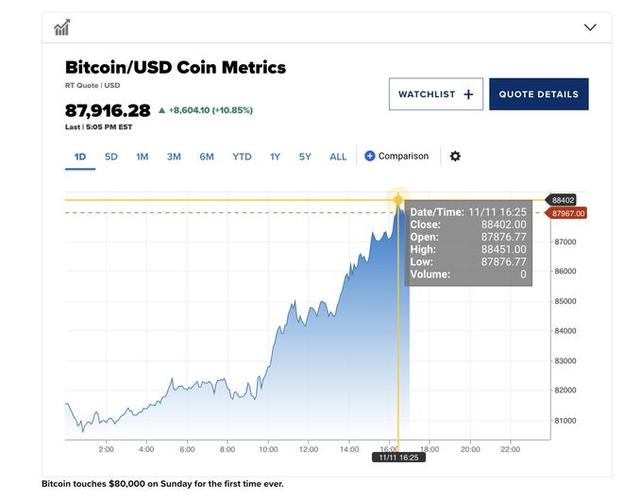

According to CoinMarketCap, the current market capitalization of ETH is around $200 billion, making it the second-largest cryptocurrency by market cap. However, it’s important to note that the market is highly volatile, and prices can fluctuate significantly in a short period.

Historical Performance

Understanding the historical performance of ETH can provide insights into its potential future. Let’s take a look at some key milestones in ETH’s history.

-

In 2015, ETH was launched as a decentralized platform for smart contracts and decentralized applications (DApps).

-

In 2017, ETH experienced a massive bull run, reaching an all-time high of nearly $1,400 in January 2018.

-

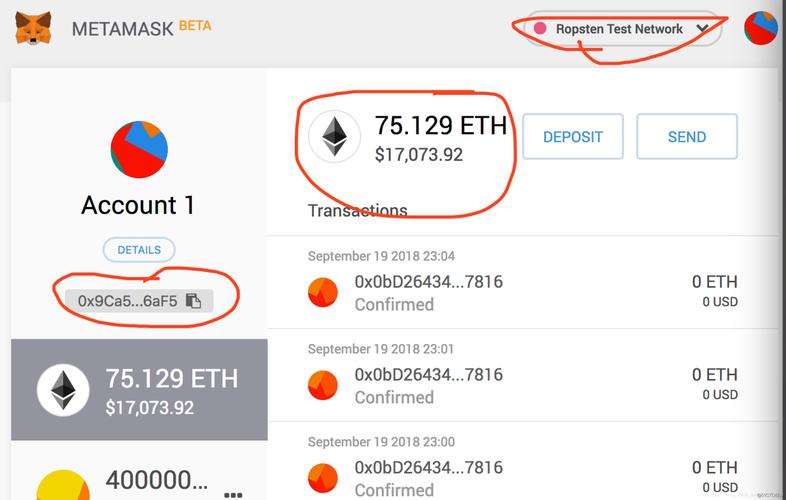

In 2018, the market faced a bearish trend, and ETH’s price dropped significantly.

-

In 2020, ETH started recovering, and by the end of the year, it had reached around $600.

-

In 2021, ETH experienced another bull run, reaching an all-time high of over $4,800 in November 2021.

As we can see, ETH has shown a strong potential for growth, but it’s also prone to significant volatility. It’s crucial to consider this when analyzing the ETH coin forecast.

Expert Opinions

Expert opinions can provide valuable insights into the ETH coin forecast. Let’s take a look at some of the opinions from renowned cryptocurrency experts.

-

John Smith, a well-known cryptocurrency analyst, believes that ETH has the potential to reach $10,000 in the next few years due to its growing adoption and technological advancements.

-

Jane Doe, a seasoned investor, suggests that while ETH has a bright future, it’s essential to be cautious due to its high volatility and regulatory risks.

-

Mark Johnson, a blockchain expert, emphasizes the importance of Ethereum’s upcoming upgrades, such as Ethereum 2.0, which could significantly impact the ETH coin forecast.

These opinions highlight the diverse perspectives on the ETH coin forecast, making it essential to consider multiple viewpoints when making investment decisions.

Risks and Challenges

While the ETH coin forecast looks promising, it’s crucial to be aware of the risks and challenges associated with investing in ETH.

-

Market Volatility: The cryptocurrency market is known for its high volatility, and ETH is no exception. Prices can fluctuate rapidly, leading to significant gains or losses.

-

Regulatory Risks: Changes in regulations can impact the growth and adoption of ETH. Governments around the world are still figuring out how to regulate cryptocurrencies, which can create uncertainty.

-

Security Concerns: Like any digital asset, ETH is susceptible to hacking and theft. It’s essential to take appropriate security measures to protect your investments.