Understanding the Exchange Rate: 0.3286129 ETH to USD

When it comes to cryptocurrency trading, one of the most crucial aspects to understand is the exchange rate. In this article, we will delve into the details of the current exchange rate between Ethereum (ETH) and the United States Dollar (USD), which stands at 0.3286129. We will explore various dimensions, including historical data, market trends, and practical implications for traders and investors.

Historical Exchange Rate Data

Understanding the historical exchange rate between ETH and USD can provide valuable insights into the market dynamics. Let’s take a look at some key data points:

| Year | ETH to USD Exchange Rate |

|---|---|

| 2017 | ~$1,000 |

| 2018 | ~$300 |

| 2019 | ~$150 |

| 2020 | ~$200 |

| 2021 | ~$4,000 |

| 2022 | ~$2,000 |

As you can see, the exchange rate has experienced significant fluctuations over the years, reflecting the volatile nature of the cryptocurrency market.

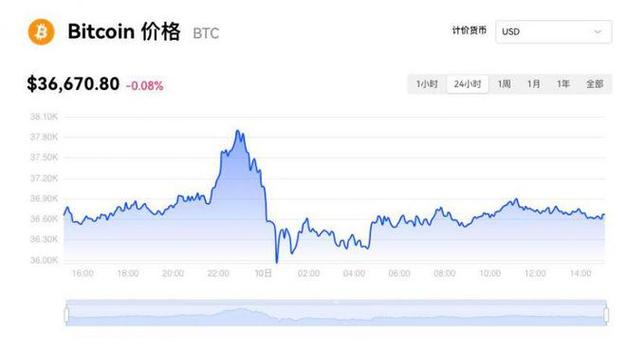

Market Trends

Understanding the current market trends is essential for making informed decisions. Let’s explore some key factors influencing the ETH to USD exchange rate:

-

Supply and Demand: The supply of Ethereum is limited, which can drive up its value. Conversely, if there is an excess supply, the value may decrease.

-

Market Sentiment: The overall sentiment in the cryptocurrency market can greatly impact the exchange rate. Positive news, such as increased adoption or partnerships, can lead to a rise in value, while negative news can cause a decline.

-

Regulatory Environment: Changes in the regulatory landscape can have a significant impact on the market. For example, stricter regulations may lead to a decrease in demand for ETH, while more favorable regulations can drive up its value.

-

Technological Developments: Innovations and advancements in Ethereum’s technology can positively influence its value. For instance, the Ethereum 2.0 upgrade is expected to improve scalability and reduce transaction fees, potentially increasing its adoption and value.

Practical Implications for Traders and Investors

Understanding the exchange rate between ETH and USD is crucial for traders and investors. Here are some practical implications:

-

Market Timing: Traders can use historical data and market trends to identify potential entry and exit points. For example, if the exchange rate has been on an upward trend, it may be a good time to buy ETH.

-

Portfolio Diversification: Investors can diversify their portfolios by including ETH, which can potentially offer higher returns compared to traditional assets. However, it’s important to conduct thorough research and consider the associated risks.

-

Staking and Yield Farming: Ethereum’s staking feature allows users to earn rewards by locking up their ETH. Understanding the exchange rate is crucial for calculating the potential returns in USD.

-

Transaction Costs: When trading ETH, it’s important to consider transaction costs, which can vary depending on the exchange rate. Higher exchange rates may result in higher transaction costs.

Conclusion

Understanding the exchange rate between ETH and USD is vital for anyone involved in the cryptocurrency market. By analyzing historical data, market trends, and practical implications, traders and investors can make more informed decisions. Keep in mind that the cryptocurrency market is highly volatile, and it’s important to stay updated with the latest news and developments.