0.75 ETH: A Comprehensive Overview

Investing in cryptocurrencies has become increasingly popular in recent years, with Ethereum being one of the most sought-after digital assets. If you’re considering adding 0.75 ETH to your portfolio, this article will provide you with a detailed and multi-dimensional introduction to help you make an informed decision.

Understanding Ethereum

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. Unlike Bitcoin, which is primarily a digital currency, Ethereum is a platform that supports various applications beyond just a digital currency.

Market Analysis

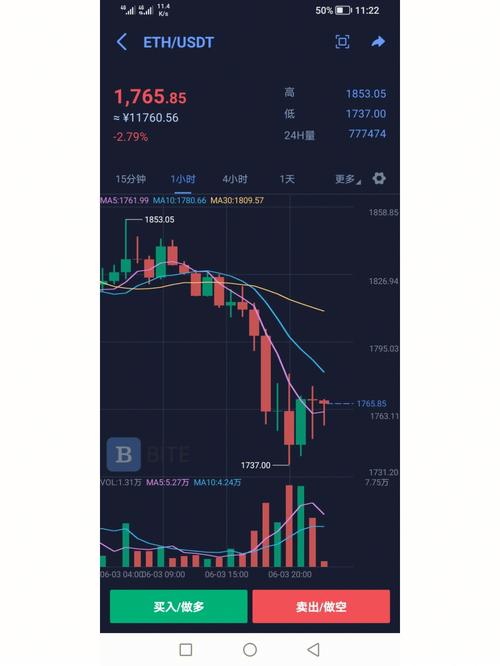

As of the latest data available, the price of Ethereum is $2,000. This represents a significant increase from its all-time low of $100 in 2018. The market capitalization of Ethereum is currently around $250 billion, making it the second-largest cryptocurrency by market cap after Bitcoin.

| Market Cap | Price | Market Rank |

|---|---|---|

| $250 billion | $2,000 | 2 |

Supply and Distribution

Ethereum has a total supply of 18 million ETH, with a maximum supply of 18 million ETH. The distribution of Ethereum is as follows:

| Category | Percentage |

|---|---|

| Founders and Early Investors | 12% |

| Community and Team | 15% |

| Foundation | 17% |

| Public Sale | 60% |

Use Cases

Ethereum has a wide range of use cases, including:

-

Smart Contracts: Ethereum’s primary use case is the creation and execution of smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code.

-

DApps: Decentralized applications (DApps) are applications that run on a blockchain network, with no central authority controlling the application.

-

Tokenization: Ethereum allows for the creation of digital tokens, which can represent ownership, access, or utility.

-

DeFi: Decentralized finance (DeFi) is a financial system built on blockchain technology, with Ethereum being one of the most popular platforms for DeFi applications.

Risks and Considerations

While Ethereum has many benefits, it’s important to be aware of the risks involved:

-

Market Volatility: The price of Ethereum can be highly volatile, which can lead to significant gains or losses.

-

Regulatory Risk: Cryptocurrencies are still subject to regulatory uncertainty, which could impact their legality and value.

-

Security Risks: As with any digital asset, Ethereum is susceptible to hacking and theft.

Investment Strategy

When considering an investment in 0.75 ETH, it’s important to have a clear investment strategy:

-

Research: Conduct thorough research on Ethereum, its use cases, and the market conditions.

-

Understand Your Risk Tolerance: Determine how much risk you’re willing to take on and allocate your investment accordingly.

-

Stay Informed: Keep up-to-date with the latest news and developments in the cryptocurrency market.

-

Consider Diversification: Don’t put all your eggs in one basket; diversify your investment portfolio.