Understanding the .5 ETH Price: A Comprehensive Guide

When it comes to cryptocurrencies, the price of Ethereum (ETH) is a topic of great interest. In this article, we delve into the intricacies of the .5 ETH price, exploring various dimensions to provide you with a comprehensive understanding. Whether you’re a seasoned investor or a beginner in the crypto space, this guide will equip you with the knowledge to make informed decisions.

What is .5 ETH?

.5 ETH refers to half of one Ethereum unit. Ethereum is a decentralized platform that enables smart contracts and decentralized applications (DApps). The price of .5 ETH is determined by the current market value of Ethereum, which fluctuates based on supply and demand dynamics.

Market Dynamics

The price of .5 ETH is influenced by various factors, including market sentiment, technological advancements, regulatory news, and macroeconomic conditions. Let’s explore some of these factors in detail:

| Factor | Description |

|---|---|

| Market Sentiment | Investor confidence and sentiment play a crucial role in determining the price of .5 ETH. Positive news, such as increased adoption or partnerships, can lead to a rise in price, while negative news can cause a decline. |

| Technological Advancements | Developments in Ethereum’s technology, such as the upcoming Ethereum 2.0 upgrade, can significantly impact the price of .5 ETH. These advancements can enhance the network’s scalability, security, and efficiency, making it more attractive to users and investors. |

| Regulatory News | Regulatory news, such as new policies or regulations, can have a substantial impact on the price of .5 ETH. For instance, favorable regulations can boost investor confidence, while strict regulations can lead to a decline in price. |

| Macroeconomic Conditions | Global economic conditions, such as inflation rates, interest rates, and currency fluctuations, can indirectly affect the price of .5 ETH. Investors often seek alternative investments, such as cryptocurrencies, during economic downturns. |

Historical Price Analysis

Understanding the historical price of .5 ETH can provide valuable insights into market trends and potential future movements. Let’s take a look at some key historical price points:

| Year | Price of .5 ETH |

|---|---|

| 2017 | $250 |

| 2018 | $125 |

| 2019 | $62.50 |

| 2020 | $31.25 |

| 2021 | $15.63 |

As you can see, the price of .5 ETH has experienced significant volatility over the years. It’s important to note that historical prices are not a guarantee of future performance, but they can provide a reference point for market trends.

Investment Strategies

Understanding the .5 ETH price is essential for making informed investment decisions. Here are some strategies to consider:

-

Long-term Investment: If you believe in the long-term potential of Ethereum, consider holding .5 ETH for an extended period. This strategy requires patience and a willingness to ride out market volatility.

-

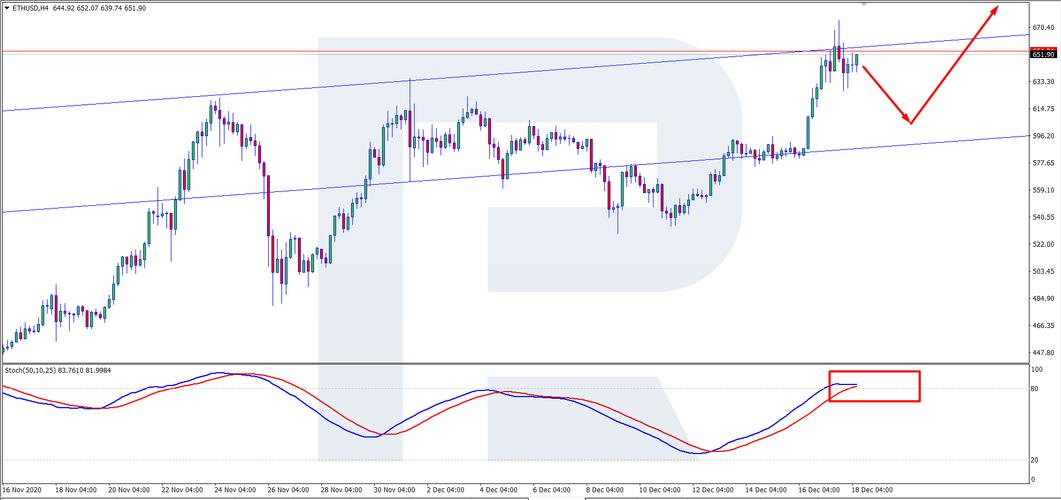

Short-term Trading: For those who prefer active trading, keep an eye on market trends and technical indicators to make informed decisions. This strategy requires a higher level of risk tolerance and market knowledge.

-

Diversification: Consider diversifying your portfolio by investing in other cryptocurrencies or assets. This can help mitigate risk and potentially enhance returns.

Conclusion

Understanding the .5 ETH price requires a comprehensive analysis of market dynamics, historical data, and investment strategies. By staying informed and making informed