Understanding the Eth Coin Price Chart: A Detailed Overview

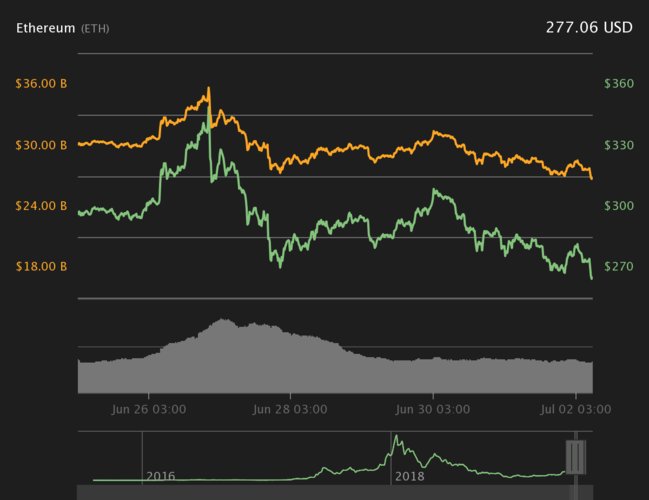

When it comes to cryptocurrencies, Ethereum (ETH) stands out as one of the most popular and influential digital assets. Its price chart, a visual representation of its value over time, is a critical tool for investors, traders, and enthusiasts alike. In this article, we’ll delve into the various dimensions of the ETH coin price chart, providing you with a comprehensive understanding of its dynamics and factors influencing its value.

Historical Price Performance

The Ethereum price chart has seen a rollercoaster ride since its inception in 2015. Initially valued at just a few cents, ETH has surged to become one of the top cryptocurrencies by market capitalization. Let’s take a look at some key milestones in its historical price performance:

| Year | Price Range | Notable Events |

|---|---|---|

| 2015 | $0.30 – $2.00 | Launch of Ethereum and initial coin offering |

| 2016 | $10 – $15 | First major upgrade, Homestead, released |

| 2017 | $100 – $500 | ETH reached its all-time high of $1,400 in January 2018 |

| 2018 | $100 – $200 | Market correction and bearish trend |

| 2019 | $100 – $300 | Second major upgrade, Istanbul, released |

| 2020 | $200 – $600 | ETH reached a new all-time high of $4,878 in February 2021 |

Market Factors Influencing ETH Price

Several factors contribute to the fluctuations in the ETH coin price chart. Understanding these factors can help you make more informed decisions when analyzing the market:

-

Supply and Demand: Like any other asset, the price of ETH is influenced by the basic economic principle of supply and demand. An increase in demand for ETH can drive its price up, while a decrease in demand can lead to a decline.

-

Market Sentiment: The overall sentiment in the cryptocurrency market can significantly impact ETH’s price. Positive news, such as regulatory approvals or partnerships, can boost investor confidence and drive up prices, while negative news can have the opposite effect.

-

Technological Developments: Ethereum’s ongoing development, including upgrades and new features, can influence its price. For example, the release of Ethereum 2.0, a major upgrade aimed at improving scalability and reducing costs, has been a significant driver of ETH’s price.

-

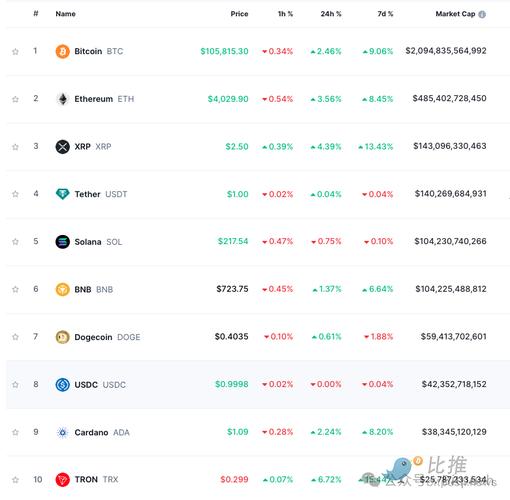

Competition: The rise of other cryptocurrencies, such as Bitcoin (BTC) and Binance Coin (BNB), can impact ETH’s market share and, consequently, its price. A strong performance by these competitors may lead to a decrease in ETH’s value.

-

Market Sentiment: As mentioned earlier, the overall sentiment in the cryptocurrency market can significantly impact ETH’s price. Positive news, such as regulatory approvals or partnerships, can boost investor confidence and drive up prices, while negative news can have the opposite effect.

Technical Analysis of the ETH Coin Price Chart

Technical analysis involves studying historical price and volume data to identify patterns and trends that can help predict future price movements. Here are some key technical indicators and chart patterns to consider when analyzing the ETH coin price chart:

-

Trend Lines: Trend lines help identify the direction of the market. An upward trend line indicates a bullish market, while a downward trend line suggests a bearish market.

-

Support and Resistance Levels: These levels represent price points where the market has repeatedly struggled to move above (resistance) or below (support