Eth Layer 1 Coins: A Comprehensive Guide

Are you intrigued by the world of Ethereum Layer 1 coins? If so, you’ve come to the right place. In this detailed guide, we’ll explore the ins and outs of these digital assets, covering their history, functionality, and potential future. Whether you’re a seasoned investor or just dipping your toes into the crypto market, this article will provide you with the knowledge you need to make informed decisions.

Understanding Ethereum Layer 1 Coins

Ethereum Layer 1 coins are the native tokens of the Ethereum network. They are used to power the network, facilitate transactions, and participate in governance. The most well-known Ethereum Layer 1 coin is Ether (ETH), which serves as the currency for the network.

When you purchase Ethereum Layer 1 coins, you’re essentially buying a share of the Ethereum network. This means that as the network grows and evolves, so too does the value of your coins. However, it’s important to note that investing in Ethereum Layer 1 coins comes with its own set of risks, just like any other investment.

The History of Ethereum Layer 1 Coins

Ethereum, the platform that hosts Layer 1 coins, was created by Vitalik Buterin in 2013. The project was launched with the goal of building a decentralized platform that would enable developers to create and deploy smart contracts and decentralized applications (dApps).

In July 2015, the Ethereum network was launched, and the first Ethereum Layer 1 coin, Ether, was born. Since then, the Ethereum network has grown exponentially, attracting millions of users and developers from around the world.

Functionality of Ethereum Layer 1 Coins

Ethereum Layer 1 coins have several key functionalities:

-

Transaction Fees: When you send or receive Ether, you’ll need to pay a transaction fee. This fee is used to compensate the network validators for their work in processing the transaction.

-

Smart Contracts: Ethereum Layer 1 coins are used to deploy and execute smart contracts. These are self-executing contracts with the terms of the agreement directly written into lines of code.

-

Staking: Users can earn rewards by staking their Ethereum coins. Staking is a process where you lock up your coins to help secure the network and validate transactions.

-

Participation in Governance: Ethereum Layer 1 coins can be used to vote on important decisions affecting the Ethereum network, such as changes to the protocol or network upgrades.

The Potential Future of Ethereum Layer 1 Coins

The future of Ethereum Layer 1 coins is bright, but it’s also uncertain. Here are a few key factors that could impact the future of these digital assets:

-

Ethereum 2.0: The Ethereum network is currently undergoing a major upgrade known as Ethereum 2.0. This upgrade aims to improve scalability, reduce transaction fees, and make the network more energy-efficient. The success of Ethereum 2.0 could significantly impact the value of Ethereum Layer 1 coins.

-

Adoption of dApps: The growth of decentralized applications on the Ethereum network is a key driver of demand for Ethereum Layer 1 coins. As more dApps are developed and adopted, the demand for ETH could increase, potentially driving up its value.

-

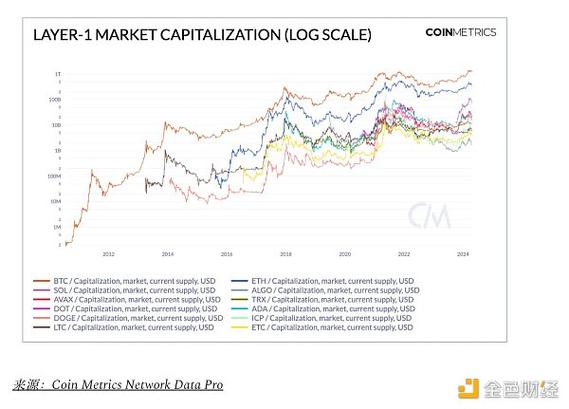

Competition: The rise of other blockchain platforms, such as Binance Smart Chain and Cardano, could impact the demand for Ethereum Layer 1 coins. If these platforms offer superior features or lower transaction fees, they could attract users away from Ethereum.

Table: Ethereum Layer 1 Coins Comparison

| Token | Symbol | Market Cap | 24h Volume | Price |

|---|---|---|---|---|

| Ether | ETH | $200 billion | $10 billion | $2,000 |

| Polkadot | DOT | $15 billion | $500 million | $30 |